I have been a Quickbooks user for many years. We no longer have a business and I no longer want/need to pay for QB. It’s great software! Very functional and feature-rich. I am not always happy with Intuit, but it’s a huge software corporation, just like Microsoft – replete with problems! I need to perform these functions:

- Keep check registers

- Reconcile accounts

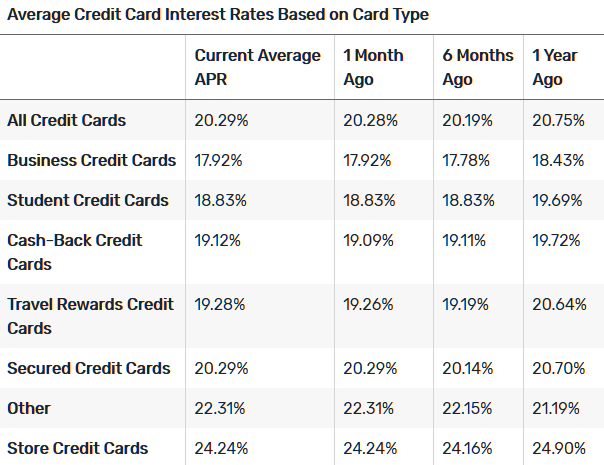

- Download credit card transactions (can download in excel)

- Create accounts to sort income & expenses

- Run reports – of course will not have the robust reports that QB has

I am aware of MS Money in Excel. I am also aware that there are many other financial software providers out there (like Mint). I am not willing to give up my bank account passwords to them or any third parties. QB doesn’t save passwords. (And btw if you use those products, are you aware that your bank will not support you if there is a breach and your account is hacked- you are on your own!)

I’ve checked a few of the budget templates, but none of them seem what I am looking for. Is anyone using Excel in for keeping finances? How are you doing it? What template are you using, if any? How are you doing monthly reconcile of accounts? I know it won’t be as nice as Quickbooks, but I am hoping I can make it work for my simple needs. thanks.